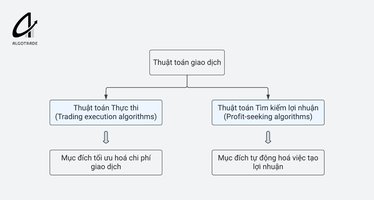

Algorithmic trading theory and practice: a practical guide with applications on the Vietnamese stock market

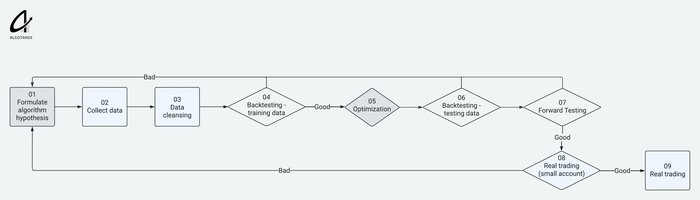

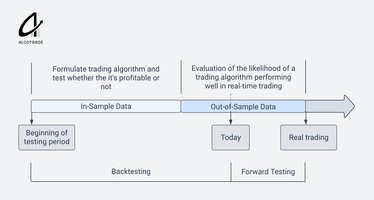

Algorithmic trading theory and practice: a practical guide with applications on the Vietnamese stock market, is a book for you. It covers the entire process of building an algorithmic trading system and a roadmap to turn ideas into real investment st