The method of calculating the final payment price of VN30F1M from June 1, 2022

According to Decision No. 61/QD-VSD, signed by the General Director of the Vietnam Securities Depository Center (VSD) on May 16, 2022, the method of calculating the final settlement price (FSP) of futures contracts ( Futures contract) VN30 index from" is the closing value of the underlying index on the last trading day" to" is the simple arithmetic average of the index in the previous 30 minutes of the expiration day (including 15 minutes of continuous order matching and 15 minutes of periodic closing), after excluding the three highest index values and the three lowest index values of the continuous matching session".

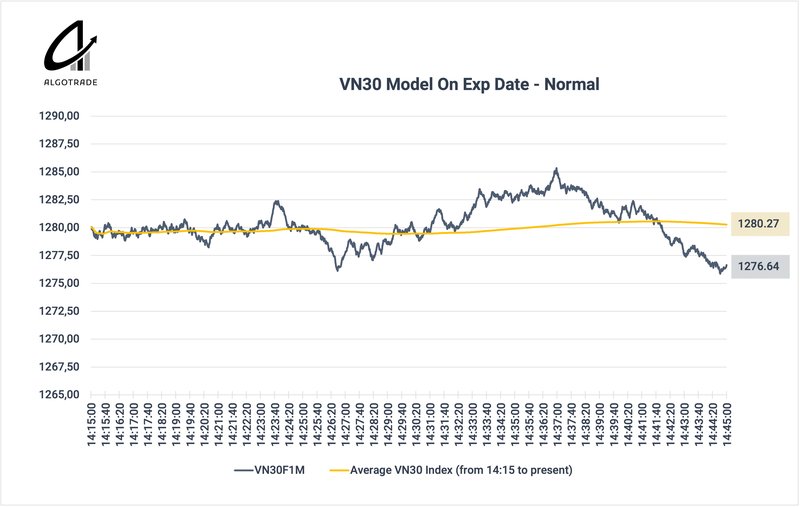

Thus, investors participating in VN30F1M futures contracts from June onwards will not fix the expiration price at the closing price of VN30 as before but will be the average of the VN30 index in 30 minutes from 2:15:00 to 2:45:00.

With the mathematical model of VN30F1M on the expiration date, VN30F1 M's final settlement price will be 1280.27 instead of 1276.64.

The new calculation method avoids the risk of unexpected price changes at the expiration session.

Investors holding VN30F1M futures contracts are probably not too strange with the fact that the closing price of the expiration session can suddenly increase or decrease by dozens of points in the last 5 seconds of the expiration session. This change is equivalent to an increase or decrease of massive profits/losses per contract held at maturity.

This sudden price change gives a considerable advantage to the parties that can influence the closing price.

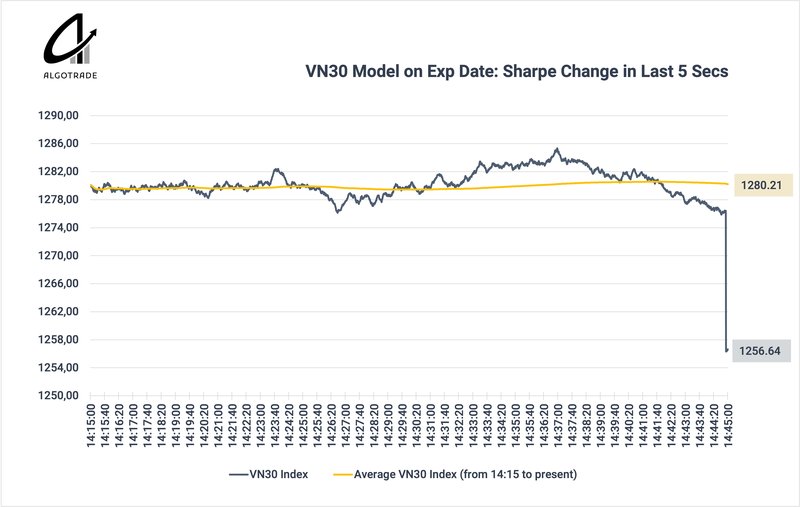

With the newly issued final settlement price calculation method. Assuming that in the last 5 seconds of the expiration date, the VN30F1M price drops 20 points, the closing price model will work as follows:

According to the current pricing method, the final payment price of VN30F1M is 1256.64, while under the newly updated pricing method, the final payment price of VN30F1M is: 1280.21.

Investors can see that the change of 20 points in the last 5 seconds of the session almost did not change the closing price of VN30F1M.

Thus, unlike previous expirations, the newly updated pricing method has successfully handled the risk of price changes in the last seconds.

New pricing method, a new risk of manipulation

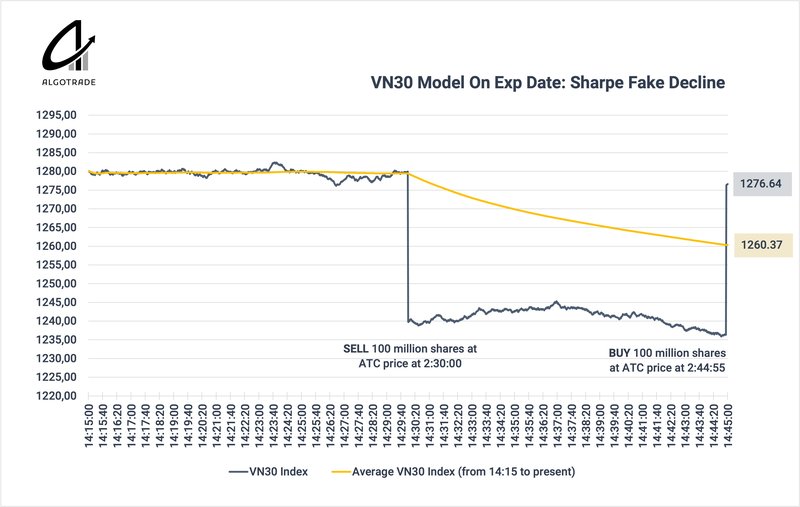

Succeeding in thoroughly handling the last seconds of price impact risk in the expiration date. However, the new calculation still carries significant risk if stakeholders influence the market by selling substantial quantities of stocks on VN30 at 2:30:00 in the expiration session and buying back the same amount sold at 2:44:55s.

After closing these transactions, the underlying positions of the parties involved will not change. However, with this trading method, the closing price of VN30F1M may be significantly affected.

Suppose an investor sells ATC 100 million shares in the VN30 list at 2:30:00, causing a significant drop of 40 points on the VN30 index. At 2:44:55s, investors bought back exactly 100 million shares with ATC orders. The following is a hypothetical expiration pricing model.

With the above transactions, the buyer/seller of the stock did not change the actual position but was able to change the closing price of the VN30F1M futures contract. With this assumption, VN30F1M will close at the new price of: 1260.37 while VN30 closes at 1276.64 as usual.

Buying and selling a large number of counterpart shares in the ATC session changed more than 16 points in the closing price of VN30F1M.

Thus, price manipulation has not been completely avoided according to the above mathematical model. Investors still need to be very careful in the expiration session.

Proposing how to calculate the final payment price of VN30F1M

Methodology:

- Remove the weight of periods where prices may not appear due to supply and demand in VN30, which is from 2:30:00 to 2:44:45.

- Add weight to the ATC closing price instead of a simple arithmetic average to ensure balance.

The proposed formula for calculating the final settlement price of a futures contract is as follows:

"is the sum of the index's simple arithmetic mean for the last 30 minutes of the last trading day's continuous session, after excluding the top 3 index values and the lowest three index values of the continuous matching session multiplied by 0.8 and the closing price on ATC session multiplied by 0.2".

The objective of this calculation method is to keep the benefits of price averaging and avoid the overwhelming impact of sudden price changes at the close while ensuring the complete elimination of the possibility of price manipulation during a period that may have fake supply and demand.

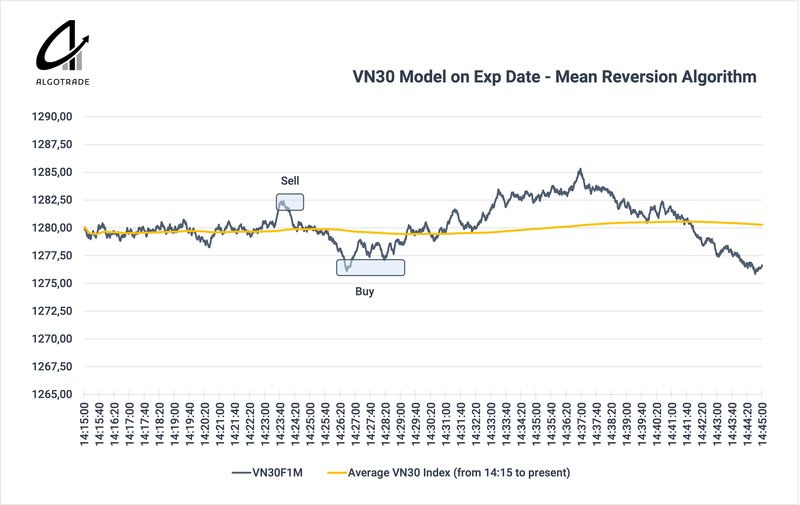

Possibility of developing mean reversion algorithm

The risk of significant price changes during the ATC session is present. However, algorithmic traders still have the opportunity to profit from the mean regression trend of VN30F1M to the VN30 index.

Here's a simple example illustrating how the algorithm works: (assuming VN30F1M moves along with VN30)

The algorithm works on the basic principle that VN30F1M moves away from the median price of the VN30.

Algorithmic traders applying this strategy need to manage the risks that may occur during the ATC session, as mentioned in this article.